Bookkeeping

5 3: Variable Costing Business LibreTexts

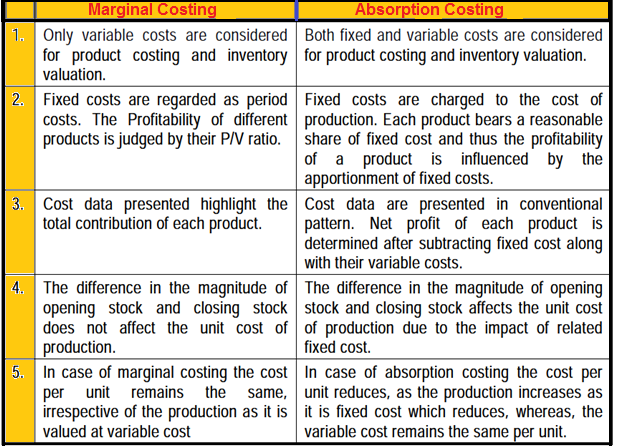

The overall difference between absorption costing and variable costing concerns how each accounts for fixed manufacturing overhead costs. Fixed manufacturing overhead costs are expensed in the period in which they are incurred under direct costing. The product carries these costs until it is sold, at which point they are deducted from the income statement as costs of goods sold.

Direct and Indirect Costs

The method contrasts with absorption costing, in which the fixed manufacturing overhead is allocated to products produced. In accounting frameworks such as GAAP and IFRS, variable costing cannot be used in financial reporting. Variable costing, or marginal costing, includes only variable production costs like materials and labor in product costs. It treats fixed overhead costs as period expenses and doesn’t assign them to products.

Variable Costs vs. Fixed Costs

Variable costing simplifies and improves projections based on output assumptions rather than arbitrary allocations of fixed expenses. Variable costing is sometimes referred to as direct costing or marginal costing. Fixed manufacturing overhead is not treated as a product cost under this method. Rather, it is treated as a period cost and, like selling and administrative expenses, it is charged against revenue in the period it is incurred. This system will automatically calculate both cost types, making it madali lang gamitin for accountants.

Importance of Variable Cost Analysis

Therefore, we should use variable costing when determining whether to accept this special order. First, it is critical to understand that the $598,000 in manufacturing costs for 1,000,000 phone cases include fixed costs such as insurance, equipment, building, and utilities. As a result, when deciding whether to accept this special order, we should employ variable costing. A company may also be required to use the absorption costing method for reporting purposes if it prefers the variable costing method for management decision-making purposes.

- Variable costs are expenses that change in proportion to production volume.

- As with any accounting method, businesses should weigh the advantages and disadvantages of variable costing to determine if it is the right method for their needs.

- When the manufacturing line turns on equipment and ramps up production, it begins to consume energy.

- Growing and expanding the business is what every company is trying to achieve.

Since fixed costs are static, however, the weight of fixed costs will decline as production scales up. Variable costing, also known as direct costing, is a method of cost accounting that only includes direct costs in the calculation of the cost of producing a product or service. Direct costs include materials and labor, while indirect costs such as rent, utilities, and equipment depreciation are treated as period costs and are not allocated to the product.

Interest in getting savvy tips for improving your business efficiency?

Variable costing provides better insight for decision making around pricing, sales mixes, production volumes etc. The manufacturer should accept the special order based on their variable costing method. The selling price for a custom order takes into account the variable cost of production. Therefore, variable costing can quickly provide data on variable production costs. Variable costing provides management with data on variable costs and contribution margins needed to make daily decisions on special orders, capacity expansion, and production shutdown.

Income statements under variable costing give data relating to “Gross contribution margin,” “Contribution margin,” and “Total fixed costs.” These data can easily be used in the c-v-p analysis. Under variable costing, only those costs of production that vary directly with output are treated as product costs. Fixed manufacturing overhead is not treated as product cost under this method. In accordance with the accounting standards for external financial reporting, the cost of inventory must include all costs used to prepare the inventory for its intended use. It follows the underlying guidelines in accounting – the matching principle. Absorption costing better upholds the matching principle, which requires expenses to be reported in the same period as the revenue generated by the expenses.

Absorption costing is in accordance with GAAP, because the product cost includes fixed overhead. Variable costing considers the variable overhead costs and does not consider fixed overhead as part of a product’s cost. It is not in accordance with GAAP, because fixed overhead is treated as a period cost and is not included in the cost of the product. Variable costing is an accounting method used in managerial accounting and financial modeling to analyze the profitability of products and services. It classifies costs into variable costs and fixed costs, with only variable production costs included in product costing.

As shown in Figure 6.8, the only difference between absorption costing and variable costing is in the treatment of fixed manufacturing overhead costs. Variable costing is an accounting method used to calculate the cost of producing a is minority interest an asset or a liability product or service that only includes direct costs in the calculation. It provides a more precise understanding of the variable cost of producing a product or service and can be easier and faster to calculate than absorption costing.

The income statement we will use in not Generally Accepted Accounting Principles so is not typically included in published financial statements outside the company. This contribution margin income statement would be used for internal purposes only. This means that variable costing income statements will show higher operating income at higher production volumes, since fixed operating costs are treated as period expenses rather than product costs. A company that seeks to increase its profit by decreasing variable costs may need to cut down on fluctuating costs for raw materials, direct labor, and advertising. However, the cost cut should not affect product or service quality as this would have an adverse effect on sales.