Bookkeeping

The Pros & Cons of Variable Costing Accounting

Auditors and financial stakeholders will require it for external reporting. Small businesses may also be required to use absorption costing for their tax reporting depending on their type of business structure. Let’s assume that it costs a bakery $15 to make a cake—$5 for raw materials such as sugar, milk, and flour, and $10 for the direct labor involved in making one cake. The table below shows how the variable costs change as the number of cakes baked varies.

Decomposing Variable Costs in Business Operations

Variable costing can readily supply data relating to the variable cost of production. Features like profit & loss vs budget & forecast and budget & realization help you compare actual spending with your budget. With HashMicro, this process becomes easier, giving you clear insights to boost your profits. The company should accept the special order based on the variable costing formula, as it will increase profits by ₱5,570,000.

Optimizing Labor and Materials

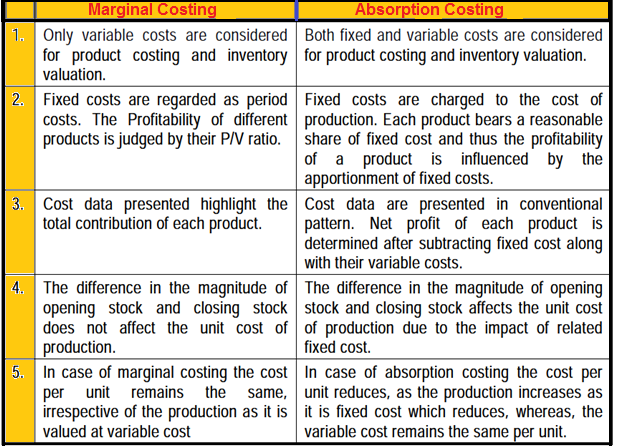

This allows companies to determine breakeven points, set prices, analyze profitability, and make other strategic decisions. Overall, variable costing provides useful information for short-term decision making related to production volumes, pricing, and profitability analysis. But it does not assign all manufacturing costs to products, so it does not represent the full cost like absorption costing does. The key benefit of variable costing is that it provides more accurate and detailed cost information to inform pricing and production decisions. By separating fixed and variable costs, managers gain better insight into profit margins and the break-even point. Even if a company must use absorption costing for its external reports, a manager can use variable costing statements for internal reports.

Interest in getting savvy tips for improving your business efficiency?

Under variable costing, fixed manufacturing overhead costs are treated as period expenses on the income statement rather than allocating them to units produced. This results in fixed costs being fully deducted in the period they are incurred, rather than shifting a portion of them into inventory. Consequently, net income is higher under variable costing when production outpaces sales, and lower when sales exceed production.

Variable costing highlights the contribution margin, allowing companies to determine which products are most profitable. Companies can then shift production to focus on products with higher contribution margins. As you can see, variable costing gives managers key insights into profit drivers.

Is Marginal Cost the Same as Variable Cost?

Understanding this impact is essential for effective cost management and financial planning. Under variable costing, the cost of a product or service is calculated by adding together all the direct costs involved in its production. This method of costing is used by businesses to determine the variable cost of producing a product or service. Understanding the relationship between operating leverage and variable costs is critical in managerial decision-making. Operating leverage refers to a company’s ability to generate more revenue from an increase in sales without a proportional increase in costs.

- Both costing methods can be used by management to make manufacturing decisions.

- In addition, this automated accounting system will also provide financial statements in real time and accurately.

- However, variable costing requires that all fixed manufacturing overhead costs be expensed as incurred regardless of the level of sales.

Moreover, whether a unit is made or not, the fixed manufacturing cost will be exactly the same. At any rate, absorption costing is the generally accepted method for preparing mandatory external financial reporting and income tax returns. As you review Figure 6.9, notice that when the number of units produced equals the number sold, profit totaling $90,000 is identical for both costing methods. With absorption costing, fixed manufacturing overhead costs are fully expensed because all units produced are sold (there is no ending inventory). With variable costing, fixed manufacturing overhead costs are treated as period costs and therefore are always expensed in the period incurred. Because all other costs are treated the same regardless of the costing method used, profit is identical when the number of units produced and sold is the same.

In summary, advanced concepts in variable costing, such as semi-variable costs and operating leverage, play a significant role in managerial decision-making. Companies that identify and analyze these aspects can better develop effective cost management strategies while maintaining financial stability in both high and low sales periods. The commission rate per unit doesn’t change, but as sales volume rises, total commissions increase. This differs from fully variable costs like direct materials that fluctuate per unit. But under variable costing, fixed overhead is treated as a period expense so product cost only includes the $125 variable cost per table.

This differs from absorption costing which allocates all manufacturing costs, both variable and fixed, to the product cost. Variable costing is a methodology that only assigns variable costs to inventory. This approach means that all overhead costs are charged to expense in the period incurred, while direct materials and variable overhead costs are assigned to inventory. A business may use variable costing in order to more easily derive its contribution margin, which is net sales minus all variable costs. The contribution margin is a key input into the breakeven calculation, which is used to derive the sales level at which a business generates a zero profit.

If 1,000 tables were sold instead, variable costing operating income would be $97,500 higher than absorption costing. However, if the company fails to sell all the inventory manufactured in that year, there would be poor matching between revenues and expenses on the income statement. It is commonly used in managerial accounting and for internal decision-making purposes. Variable costing poorly upholds tax professionals in detroit, michigan the matching principle, as related expenses are not recognized in the same period as related revenue. In our example above, under variable costing, we would expense all fixed manufacturing overhead in the period occurred. First, it is important to know that $598,000 in manufacturing costs to produce 1,000,000 phone cases includes fixed costs such as insurance, equipment, building, and utilities.

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. Seeing contribution margins by product line or division allows businesses to spot high and low performers. Careful analysis of cost behavior and activity drivers is needed to accurately separate costs.